Shares of Chinese power battery giant CATL, traded in Shenzhen, surged in early trading after Morgan Stanley upgraded its rating and price target.

Morgan Stanley raised its target price on CATL by 14 percent to RMB 210, citing an inflection point in its fundamentals.

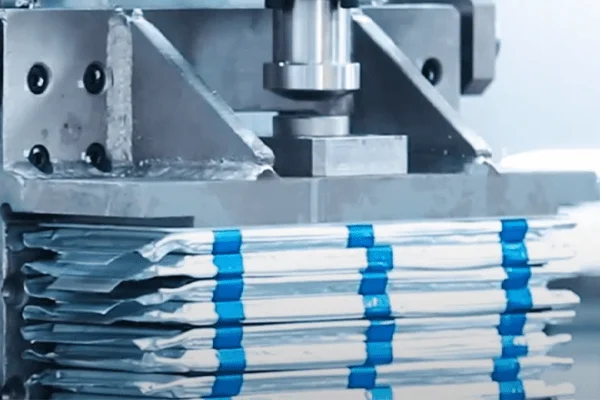

“As the price war draws to a close, CATL is poised to increase cost efficiency through a new generation of large-scale production lines, which is expected to widen its advantage in terms of return on net assets,” said Morgan Stanley analyst Jack Lu’s team in a recent research note.

The team highlighted multiple inflection points in CATL’s fundamentals and upgraded the company to Overweight from Equal Weight, selecting it as a sector top pick.

CATL’s stock appears to have reacted to the headwinds of the US Inflation Reduction Act (IRA), according to the team.

Morgan Stanley expects CATL’s EBITDA (earnings before interest, taxes, depreciation, and amortization) growth to return to year-on-year growth in the following quarters after a slowdown in the first quarter.