Bavarian electric air taxi developer Lilium announced plans to file for insolvency for two main subsidiaries, Lilium GmbH and Lilium eAircraft GmbH, following an inability to secure additional funding. This decision, disclosed in a filing to the U.S. Securities and Exchange Commission (SEC) on Thursday, follows the recent refusal by the German government to provide state aid to the startup.

Lilium stated that despite continued fundraising efforts, it has been unable to secure the necessary capital to sustain its subsidiaries’ operations, leaving the companies “over-indebted and unable to meet due liabilities.” The filing will be made to the Weilheim district court in Bavaria, with Lilium intending to pursue a form of self-administration under German insolvency law, which could allow the firm to continue its operations. “The application is not yet a death sentence,” a company spokesperson told Handelsblatt, adding that the proceedings may buy time for additional financing.

The SEC filing indicates Lilium is exploring options, including the potential sale of parts of the business, though the debt levels of the subsidiaries remain undisclosed. Handelsblatt reports that Lilium had €109 million in cash as of June but spent €190 million in the first half of 2024, raising concerns over its financial sustainability.

Lilium’s attempt to secure state support from Germany and Bavaria was unsuccessful. During negotiations, the company warned it might relocate operations outside Germany, and with insolvency imminent, such a move could still occur. Lilium N.V., the parent company listed on Nasdaq, continues to analyze whether it, too, should seek insolvency.

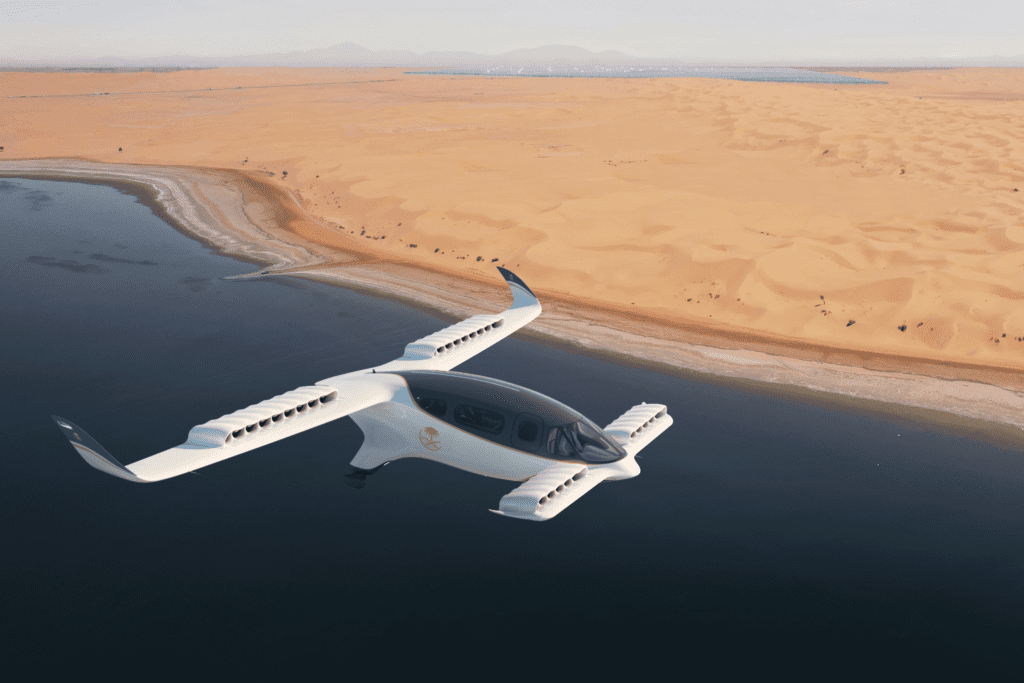

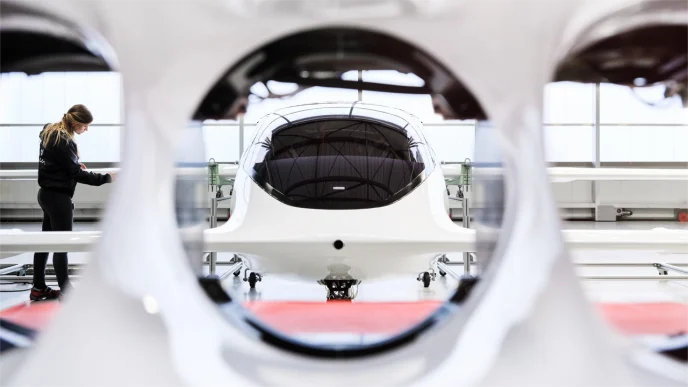

Listed in the U.S., Lilium N.V. oversees the development of the Lilium Jet and initiated small-scale production of the electric flying taxi in 2023, targeting full-scale commercial production by 2026. Lilium holds an order backlog of over 780 jets, with commitments from operators across the Americas, Europe, Asia, and the Middle East.

Funded privately by backers including Tencent, Atomico, LGT Bank, Baillie Gifford, Palantir, and Honeywell, Lilium’s investors have faced cumulative losses of €1.46 billion since its founding. The SEC filing warned that insolvency proceedings for the German units could lead to the delisting or suspension of Lilium’s stock from Nasdaq, causing Lilium’s shares to drop sharply on Thursday.

Source: Handelsblatt