Tesla is projected to report an 8% increase in third-quarter electric vehicle deliveries, driven by expanded incentives and favorable financing in China, according to Wall Street estimates.

Analysts expect the U.S. automaker to deliver 469,828 vehicles, up from 435,000 in the same quarter last year, marking its best-ever third quarter.

In response to slowing consumer spending in China, Tesla introduced a range of offers earlier this year, including insurance deals, discounted paint options, and zero-interest loans, which helped the company recover from two consecutive quarters of declining deliveries. Data from the China Passenger Car Association (CPCA) shows that these measures boosted sales in July and August.

“China, which accounts for one-third of Tesla’s sales, is a major growth driver,” said Scott Acheychek, COO of REX Financial.

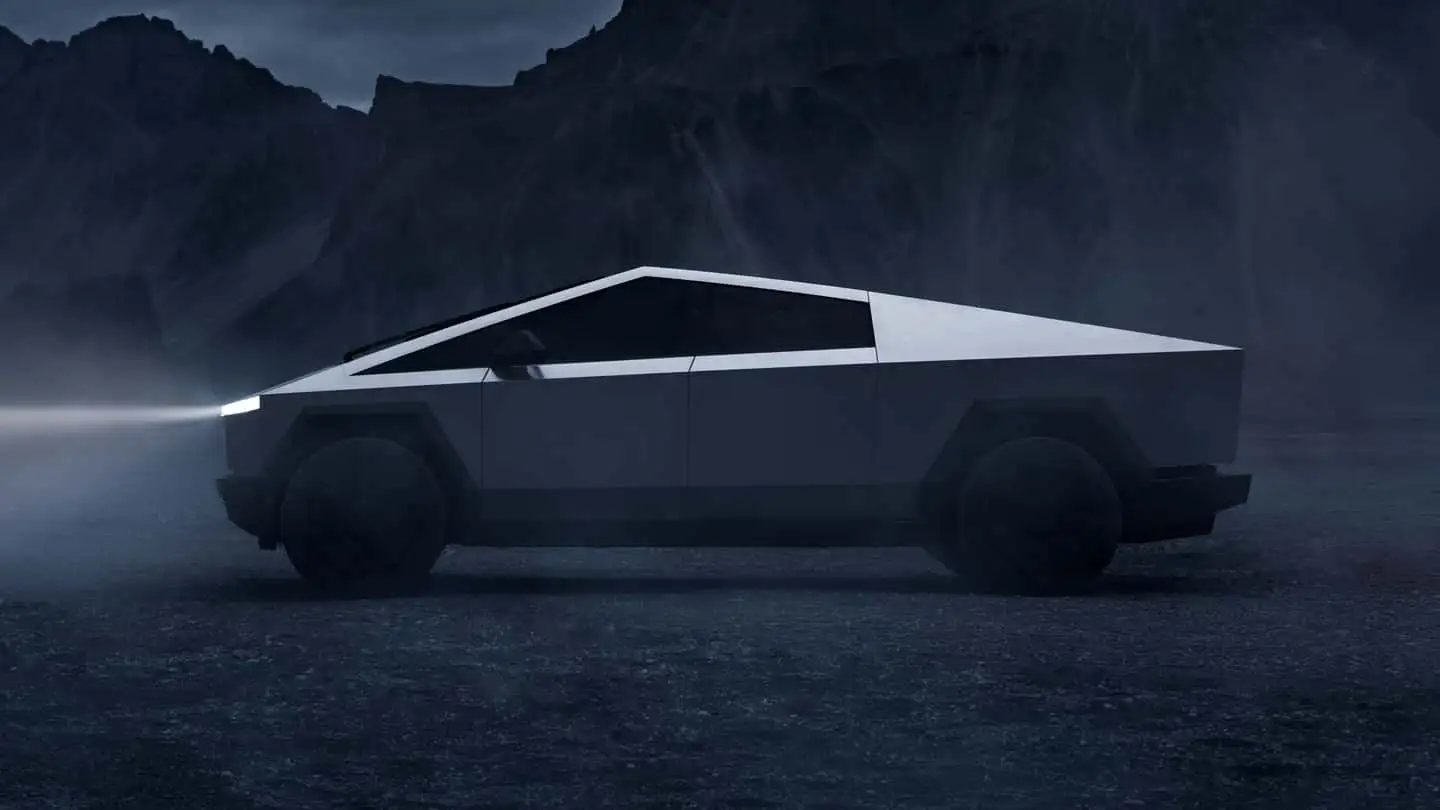

Deutsche Bank analysts estimate that Tesla will deliver around 139,000 Model 3 sedans, 296,400 Model Y SUVs, and 13,500 Cybertruck pickups in the third quarter.

Tesla’s sales in China were further supported by government subsidies and the inclusion of its Model Y SUV on a list of vehicles eligible for government purchases. Analysts see this as crucial for Tesla to maintain momentum, especially as it aims to match its record of 1.8 million vehicle deliveries in 2023.

With U.S. EV demand slowing and limited subsidies in Europe, Tesla needs to deliver around 979,000 vehicles in the second half of the year to meet investor expectations.

The upcoming unveiling of Tesla’s robotaxi product on October 10 is expected to further shift the company’s strategy and potentially unlock significant value.