The Canadian province of Alberta has announced a new $200 annual tax on electric vehicle (EV) owners, aiming to generate funds for road improvements. The tax, set to be implemented by January 1, 2025, is intended to offset the additional wear and tear on provincial roads caused by EVs and their added weight.

The government’s fiscal 2024-25 budget outlines the rationale behind the tax, noting that it roughly equals the average amount in fuel taxes paid annually by owners of internal combustion engine (ICE) vehicles.

See also: Tesla Executive Aims for Cybertruck Sales in Canada Soon

The tax is expected to raise approximately $1 million in revenue in fiscal 2024-25, increasing to $5 million in 2025-26 and $8 million in 2026-27. Despite these figures, they are significantly smaller than the $1.4 billion expected to be raised in 2024-25 through fuel taxes alone.

“While fuel tax revenue is not dedicated to funding construction and maintenance of provincial roads, there are nevertheless fairness concerns with drivers of other vehicles and longer-term challenges associated with declining fuel tax revenue,” the government stated in its budget.

Alberta’s finance minister, Nate Horner, emphasized the need for road repairs, stating, “I’m interested in fixing the roads. We need everyone to help.”

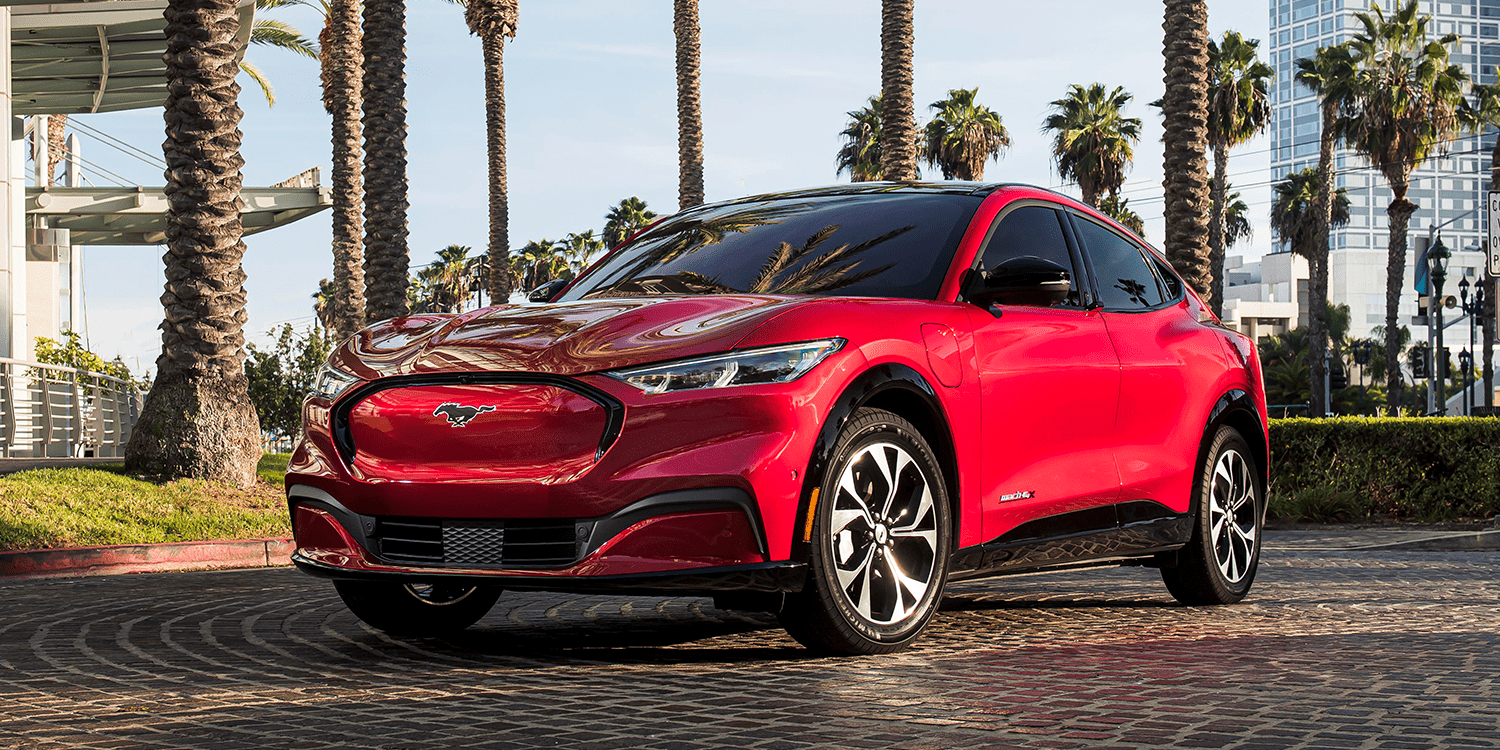

However, not everyone supports the new tax. Brian Kingston, head of the Canadian Vehicle Manufacturers’ Association representing the Detroit Three locally, believes the tax will hinder efforts to achieve ambitious EV sales targets and address barriers to EV adoption, such as affordability and charging infrastructure.

See also: Canada Nickel Co. Unveils US $1 Billion Plan for Nickel Processing Plant in Ontario

“Taxing electric vehicles will cost Albertans and make Canada’s ambitious EV sales targets even more difficult to achieve,” Kingston said. “Helping Albertans switch to electric depends on efforts from all levels of government to address the key barriers to EV adoption, including affordability and a lack of charging infrastructure.”