In a recent address to top executives at Volkswagen, Thomas Schäfer, the CEO of Volkswagen Passenger Cars, delivered a sobering message: “This is the final wake-up call.” Schäfer expressed concern over the company’s excessive spending and called for an immediate freeze on expenses to regain control.

During an online management meeting, Schäfer emphasized the need to rein in costs, stating, “We have allowed costs to spiral out of control for far too long.” As part of a comprehensive cost-cutting plan, Schäfer intends to implement spending reductions for the remainder of the year. Last month, Volkswagen unveiled its ambitious “Accelerate Forward” program, aimed at driving long-term profitability and performance.

Central to the strategy is the objective of doubling the profit margins of Volkswagen’s passenger brand, currently standing at approximately 3%, to an ambitious 6.5%. Schäfer underlined the program’s significance, stating, “The initiative holds the highest priority for the entire Board of Management.” Through the implementation of the Accelerate Forward plan, Volkswagen aims to enhance earnings by a substantial $11.2 billion (10 billion euros).

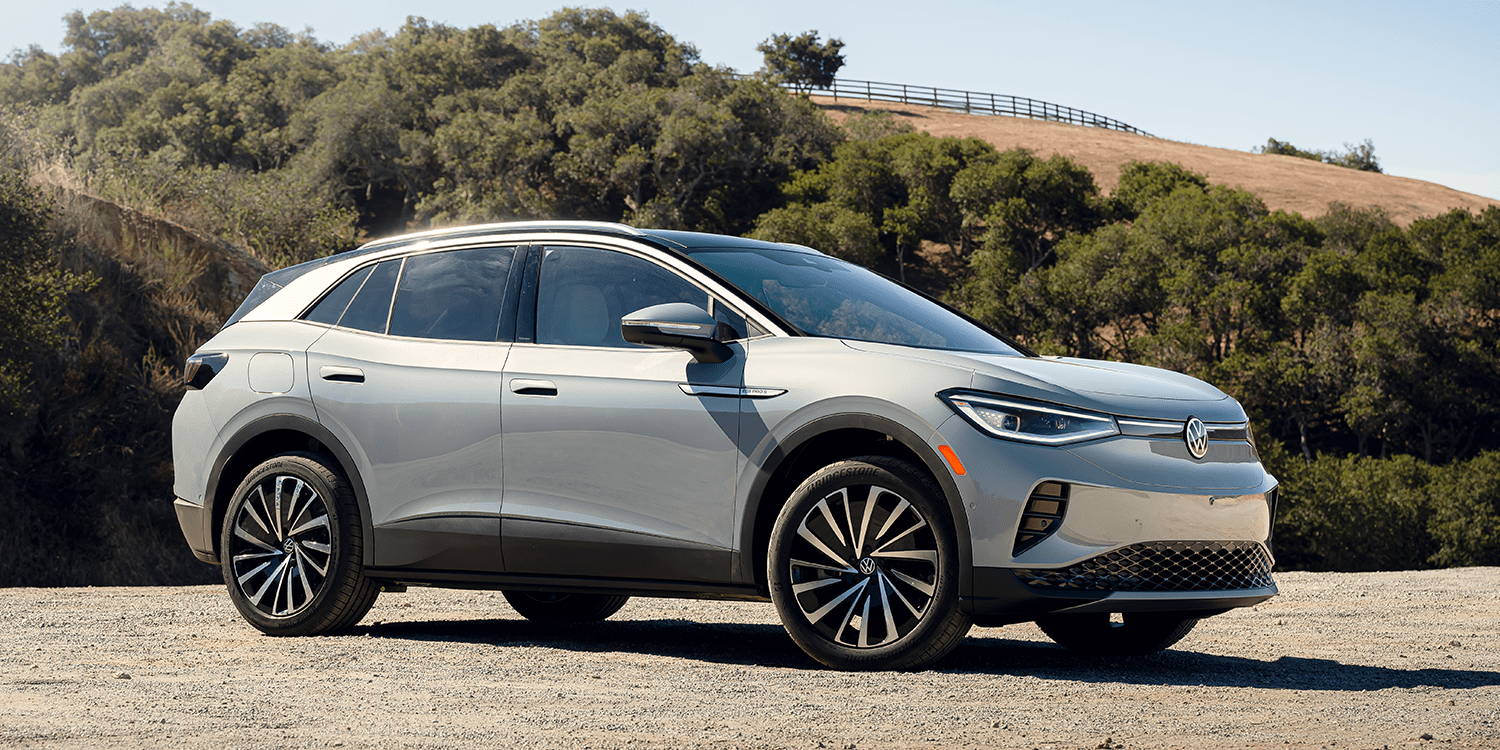

One aspect of the plan involves optimizing production efficiency by focusing on high-volume models and reducing the number of variants. To illustrate this approach, Volkswagen cited its new ID.7 model, which offers a staggering 99% fewer configuration options compared to the Golf 7 model.

Despite its efforts to bolster profitability, Volkswagen faces challenges that extend beyond profit margins. While the company experienced a remarkable 48% year-on-year increase in all-electric vehicle sales, reaching 321,600 units in the first half of the year, EV sales have declined in a critical market: China.

During the management meeting, Schäfer warned, “The roof structure is on fire. This is the final wake-up call.” The dwindling market dominance of the Volkswagen Group in China, where it generates approximately 40% of its revenue, has become a pressing concern. EV sales in China dropped by 1.5% compared to the first half of the previous year.

Moreover, although new EV registrations continue to rise in other key markets, many of these orders are carryovers from last year or even 2021. Handelsblatt suggests that Volkswagen’s demand problem stems from its “agency model” implemented with dealers during the introduction of its ID series.

While this approach helps reduce sales costs, it limits dealers’ flexibility in pricing. A VW sales representative explained, “The manufacturer cannot sell directly, which becomes evident in times like these.” The representative further added that the electric models are perceived as “simply too expensive.”

The report from Handelsblatt indicates that VW’s substantial order backlog is masking the underlying low demand. Earlier this year, the CEO of VW Group and Porsche dismissed the notion of engaging in a price war with Tesla. However, unlike Tesla, Volkswagen has struggled to generate significant profit margins from its electric models. In response, the automaker has recently introduced a limited-time offer for its ID.3 electric car in China.

Looking forward, Volkswagen is expected to explore the introduction of more affordable, entry-level models with smaller batteries. An example is the ID2 concept, which is projected to start at under $27,000 (€25,000) and offer a range of up to 279 miles (450 km).