In a dynamic turn of events, VinFast, the emerging electric vehicle (EV) startup, continues to experience erratic shifts in its share prices after an initially turbulent market entry. On Monday, the company’s shares achieved unprecedented heights, propelling its overall valuation beyond that of renowned automakers such as GM, Ford, Volkswagen (VW), and Mercedes-Benz, according to statements from investors.

VinFast made its NASDAQ debut on August 15, commencing trading at $22 per share. The stock’s trajectory was initially meteoric, soaring to an impressive $38.78 valuation, only to plummet to $13.94 later within the same week.

However, as of Monday, August 28, the share price has surged to an astonishing $89, as reported by Bloomberg. This development implies a valuation of $200 billion for VinFast, positioning it as the third most valuable automaker globally, trailing only Tesla and Toyota, while even eclipsing the market capitalizations of financial giant Goldman Sachs and aerospace leader Boeing.

It is important to note certain nuances in this assessment. Established counterparts boast more consistent stock prices, contrasting the relatively erratic nature of VinFast’s shares. Notably, the majority control of the company’s shares, to the extent of 99.7 percent, is retained by its founder, Pham Nhat Vuong. This configuration leaves only a minuscule fraction of stock accessible to external investors, a characteristic often associated with heightened volatility, as observed in the current market scenario.

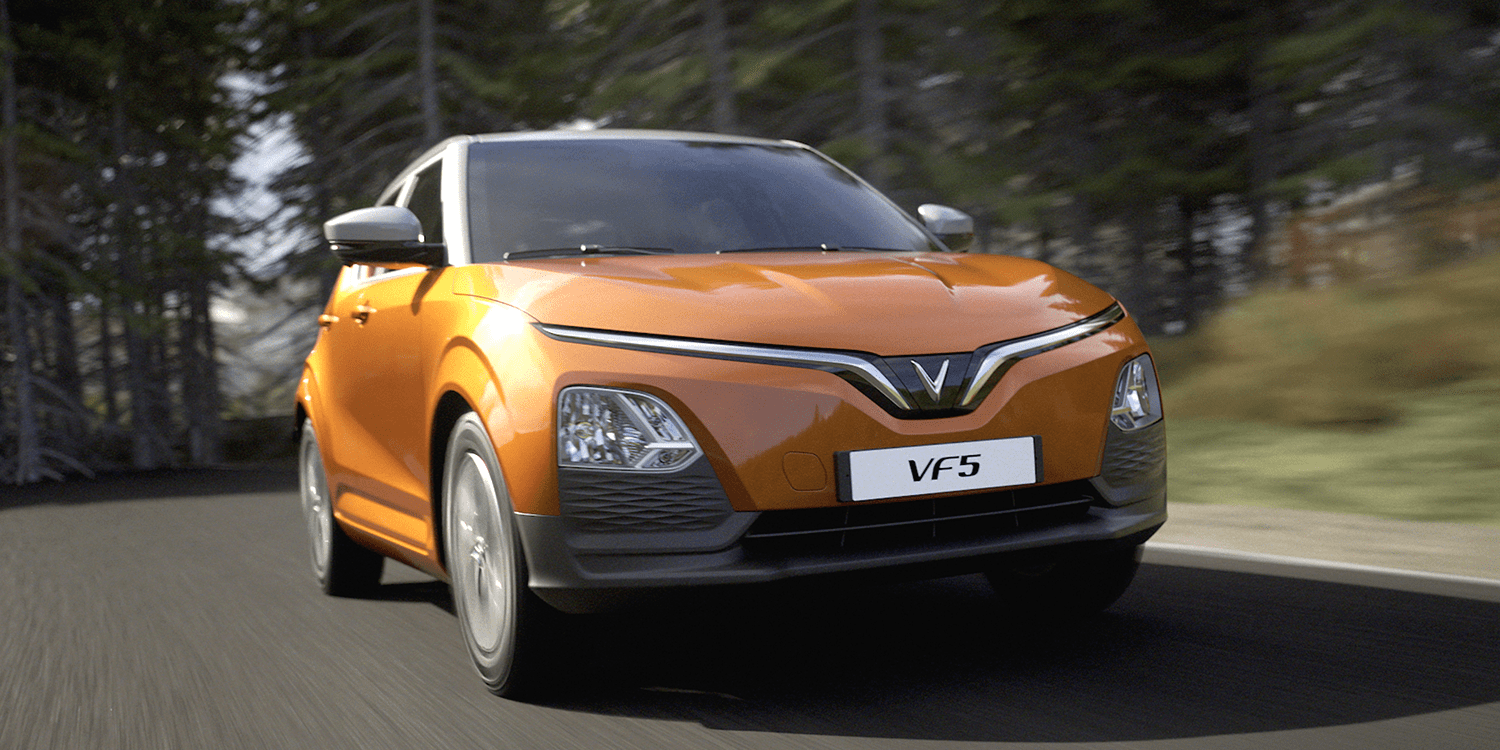

Furthermore, substantial concerns persist regarding VinFast’s competitive standing in significant markets such as the United States. While the company has demonstrated its capability to achieve notable EV production volumes—an accomplishment with inherent complexities—it has encountered challenges in selling its products in the American market, having recorded sales of a mere 137 vehicles this year.

Critiques from North American automotive analysts have also surfaced, questioning the quality of VinFast’s vehicles. The company’s history, marked by struggles to establish itself in the internal combustion engine vehicle sector prior to gaining traction with EVs in Vietnam, further amplifies doubts about its ability to navigate and succeed in the highly competitive global automotive landscape.

Amidst these circumstances, select analysts are advising investors to divest from their VinFast holdings, as reported by Investor Place. While a pessimistic outlook may not be warranted, the buoyancy of the company’s stock price appears to be disconnected from a holistic evaluation of its long-term prospects. This has led experts to characterize the surge in share performance as a potential “bubble,” susceptible to bursting with unforeseen consequences.