In the quest to democratize electric vehicles (EVs), affordability is a key factor. In countries like China, where EVs have seen widespread adoption, low raw material prices play a crucial role. However, in the United States, the path to electrification is more intricate, with the impact of decreasing raw material prices expected to be felt significantly by the end of the decade, according to new research by the International Council On Clean Transportation (ICCT).

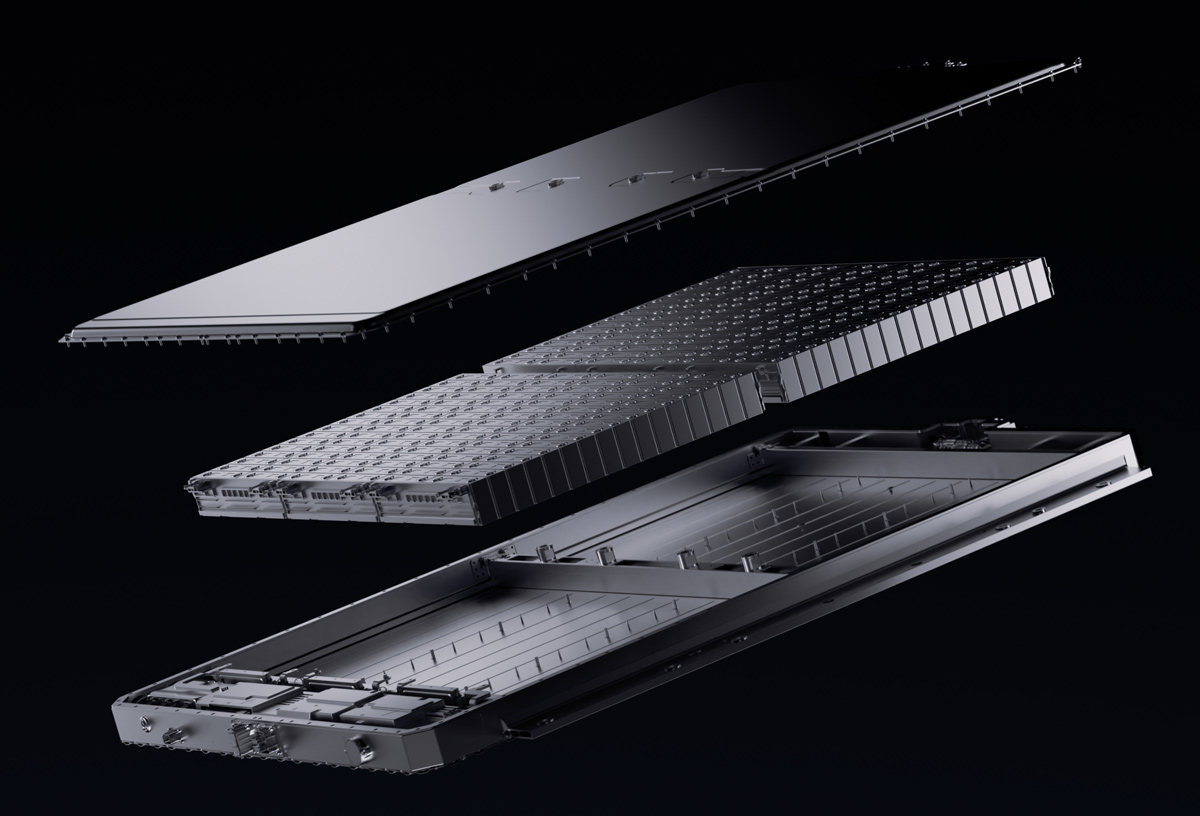

EV batteries, a critical component of electric vehicles, require minerals such as lithium, nickel, manganese, and graphite. The demand for these minerals has surged in recent years, particularly lithium, often referred to as “white gold.” As environmental concerns mount and new policies are enacted, there’s been a global rush to extract and refine lithium for EVs and other industrial applications.

See also: CATL Leads Global EV Battery Market with 36.8% in 2023, BYD Follows with 15.8%: SNE Research

Currently, most of the world’s lithium is sourced from open-pit mines in Australia and evaporation ponds in the “lithium triangle” of Argentina, Bolivia, and Chile. However, this landscape is changing. The U.S. is ramping up its lithium extraction and refining capacities, with over 100 projects underway in the U.S. and countries with which it has trade agreements.

ICCT estimates indicate that by 2032, the U.S. will need approximately 340 kilotons per annum (ktpa) of lithium carbonate equivalent for light-duty EVs. By 2025, extraction and refining capacities are projected to reach 1,310 ktpa and 1,030 ktpa, respectively, increasing to over 2,000 ktpa by 2032.

Despite currently accounting for less than 2% of the world’s lithium supply, the U.S. is expected to increase its share to 17% by 2032.

While these figures reflect global lithium output, the U.S. is poised to secure a supply that exceeds demand. Even under conservative estimates, the lithium supply for EVs will surpass demand, potentially leading to more affordable batteries and EVs. Pack level costs are expected to decline from $122 per kilowatt-hour in 2023 to about $91/kWh in 2027 and $67/kWh in 2032, making EVs cost-competitive with gas-powered cars by 2028-2029 for an average new EV with 300 miles of range.

However, these projections are contingent on factors such as the rate of battery plant development and regulatory changes. The Biden administration’s potential adjustments to the Environmental Protection Agency’s proposed standards could also impact the pace of battery price reduction and the accessibility of affordable EVs.