In a notable upswing, Rivian, the electric vehicle (EV) manufacturer, exceeded projections in the second quarter, outperforming Wall Street estimates with amplified EV sales, minimized losses, streamlined costs, and fortified supply chain operations.

Rivian’s confident stance emerged in its Q2 earnings report, released post-market closure on Tuesday. The company even heightened its annual production forecast from 50,000 to 52,000 vehicles. While still substantial, Rivian now envisions an adjusted yearly loss of $4.2 billion, a figure showing improvement from initial expectations.

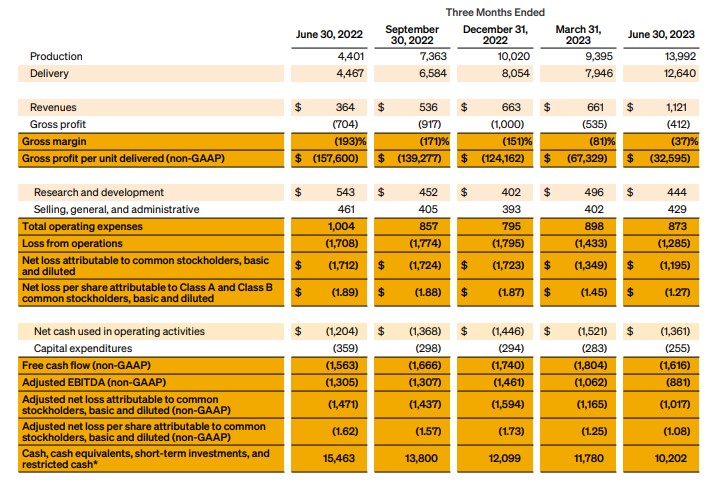

The Q2 earnings disclosure unveiled a revenue of $1.12 billion, an impressive tripling from the corresponding period last year. This surge in revenue chiefly stemmed from the delivery or sale of 12,640 vehicles. Notably, approximately $34 million of this revenue was generated through the sale of zero-emission regulatory credits, as per the company’s regulatory filing.

See also: Rivian Receives Go-Ahead from Georgia Supreme Court to Commence Construction on $5B EV Factory

Despite operating at a deficit, Rivian displayed advancements in this area as well. In Q2 2023, the net loss amounted to $1.19 billion, an improvement from the $1.7 billion loss incurred during Q2 2022. On an adjusted basis, the loss stood at $881 million, translating to $1.08 per share.

Market analysts polled by Yahoo Finance had anticipated $1 billion in revenue and an adjusted loss per share of $1.36.

Founder and CEO RJ Scaringe conveyed, “Our second quarter results reflect our continued focus on cost efficiency as we accelerate the drive towards profitability. Delivered vehicles increased by approximately 60% on a quarter-over-quarter basis, coupled with a per-vehicle gross profit improvement of around $35,000. We have achieved noteworthy reductions in costs across pivotal components such as material, overhead, and logistics for both R1 and EDV vehicle units. This robust quarter reinforces our commitment to scaling production, optimizing costs, fostering innovation, and enhancing customer satisfaction.”

A pivotal highlight emerges in Rivian’s success in overcoming substantial financial hurdles, including redefining agreements with certain suppliers. The company disclosed in its shareholder correspondence that it engaged in negotiations leading to reduced supplier costs, even eliminating short-term premiums.

Additionally, the automaker curtailed costs through strategic layoffs in 2022 and 2023, effectively trimming payroll and other expenditures.

For instance, research and development expenditures in Q2 totaled $444 million, marking an 18% reduction compared to the corresponding period last year. This decrease was primarily attributed to a $94 million cutback in payroll-related expenses, including stock-based compensation.

See also: Former Waymo CEO John Krafcik Joins Rivian’s Board of Directors

Capital expenditures also witnessed a decline to $255 million, in contrast to the $359 million recorded in the same period last year. Rivian explained that the upsurge in capital outlays during the prior year was tied to increased investments in equipment and construction during the early stages of production.

Rivian concluded the second quarter with a substantial financial cushion, boasting $10.2 billion in cash, cash equivalents, and short-term investments.