The dominance of lithium iron phosphate (LFP) batteries in the electric vehicle (EV) market is set to rise, with projections indicating they will account for over 40 percent of the EV battery market in 2024 and potentially nearly 50 percent by 2026.

This surge is primarily attributed to major automakers increasingly adopting LFP batteries due to their cost-effectiveness and safety features. However, concerns are mounting over Korean battery makers’ slow production schedules compared to their Chinese counterparts.

See also: CATL Leads Global EV Battery Market with 36.8% in 2023, BYD Follows with 15.8%: SNE Research

Research from the Yuanta Securities Research Center reveals that the global penetration rate of LFP batteries in EV battery products is expected to reach 47 percent by 2026. The market share of LFP batteries in the EV market has seen significant growth, from 17 percent in 2020 to 37 percent in 2023, with projections indicating it will expand to 41 percent in 2024.

Leading automakers such as Ford, Volvo, and Volkswagen have announced plans to expand the use of LFP batteries in their models in 2024. Additionally, GM, BMW, Mercedes-Benz, Stellantis, and Rivian are planning to incorporate LFP batteries into their EV lineups in the following year.

See also: LG Energy Solution Procures 160,000 Tonnes of LFP Cathode Material from Chinese Supplier

Despite having lower energy density and shorter range per charge compared to ternary lithium-ion batteries, LFP batteries are gaining popularity due to their affordability and high safety standards.

Chinese battery manufacturers, particularly CATL and BYD, have dominated the LFP battery market, producing over 80 percent of LFP batteries in EVs, according to the International Energy Agency (IEA). These companies are also addressing the lower energy density of LFP batteries by developing lithium manganese iron phosphate (LMFP) batteries, which offer higher energy density. CATL’s M3P battery, for example, claims a range of about 700 kilometers on a single charge.

See also: BorgWarner Forges Alliance with FinDreams Battery for LFP Battery Pack Localization

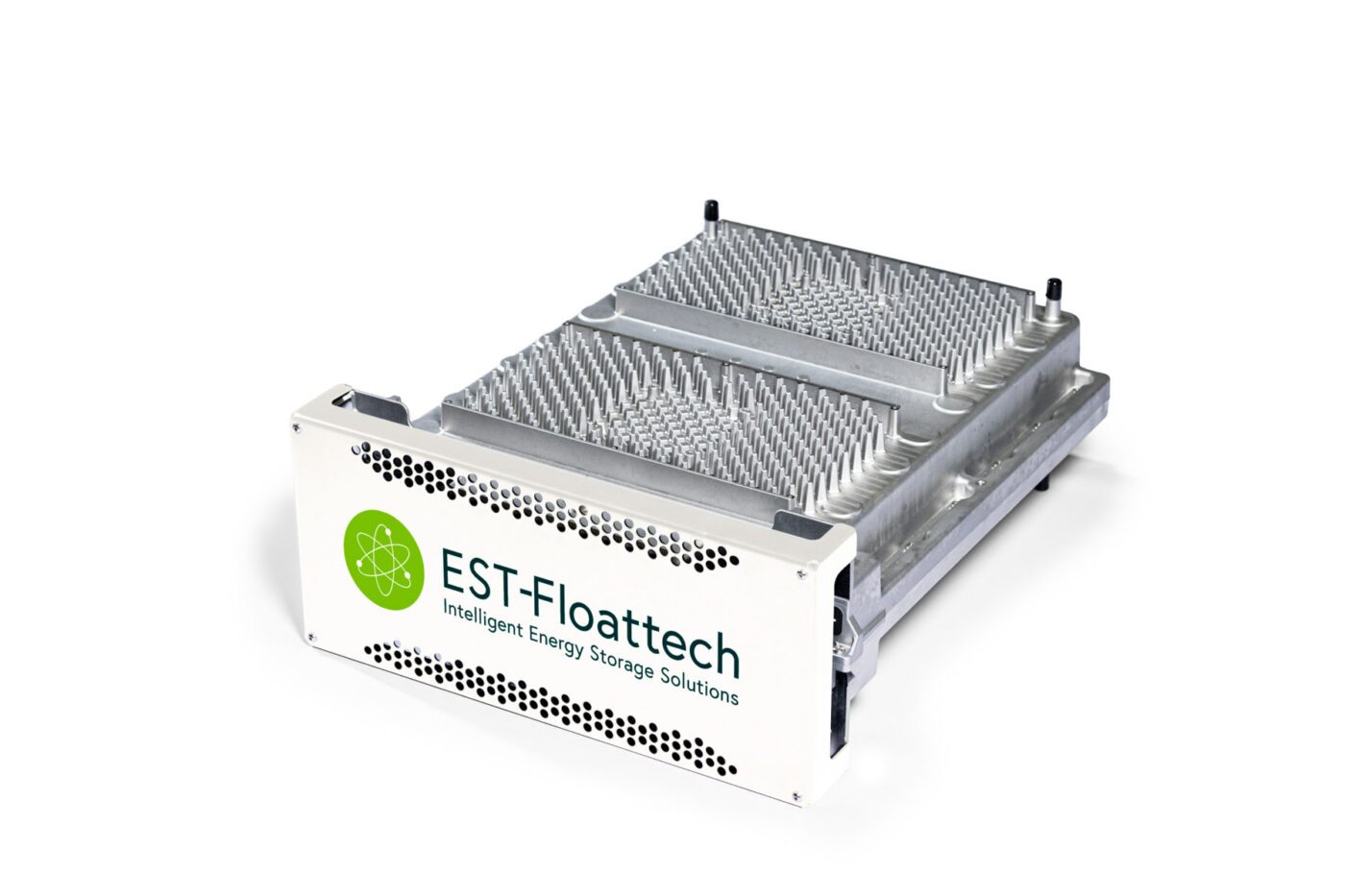

In the Energy Storage Systems (ESS) sector, Chinese companies producing LFP batteries are gaining market share, as safety is prioritized over volume and weight. However, Korean companies, traditionally focused on ternary lithium-ion battery development, are struggling to keep up with the LFP trend.

LG Energy Solution aims to start mass production of LFP batteries for EVs by the second half of 2025, while Samsung SDI is targeting the production of ESS-grade LFP batteries by 2026.