In an exciting development for prospective electric vehicle (EV) buyers, the state of Colorado has enacted a groundbreaking bill that significantly enhances the tax credit available for EV purchases. Effective from July 1st, 2023, the new legislation more than doubles the existing tax credit, making it an impressive $5,000. This bold move by Colorado aims to make a wide range of EVs more affordable and within reach for potential buyers.

Previously, Colorado offered a tax credit of up to $2,000 to new EV buyers. However, under the new legislation, the maximum tax credit amount has been increased to $5,000, as long as the vehicle’s manufacturer’s suggested retail price (MSRP) does not exceed $80,000. Notably, this state tax credit can be combined with any federal tax credits, potentially resulting in total savings of up to $12,500.

Looking ahead to 2024, an additional tax credit of $2,500 will be available for EVs with an MSRP under $35,000. This means that the total savings could potentially reach an impressive $15,000, provided the vehicle qualifies for the full $7,500 federal tax credit. In practical terms, this could bring down the price of a vehicle with an MSRP of $34,999 to an attractive $19,999, making EVs even more accessible for consumers.

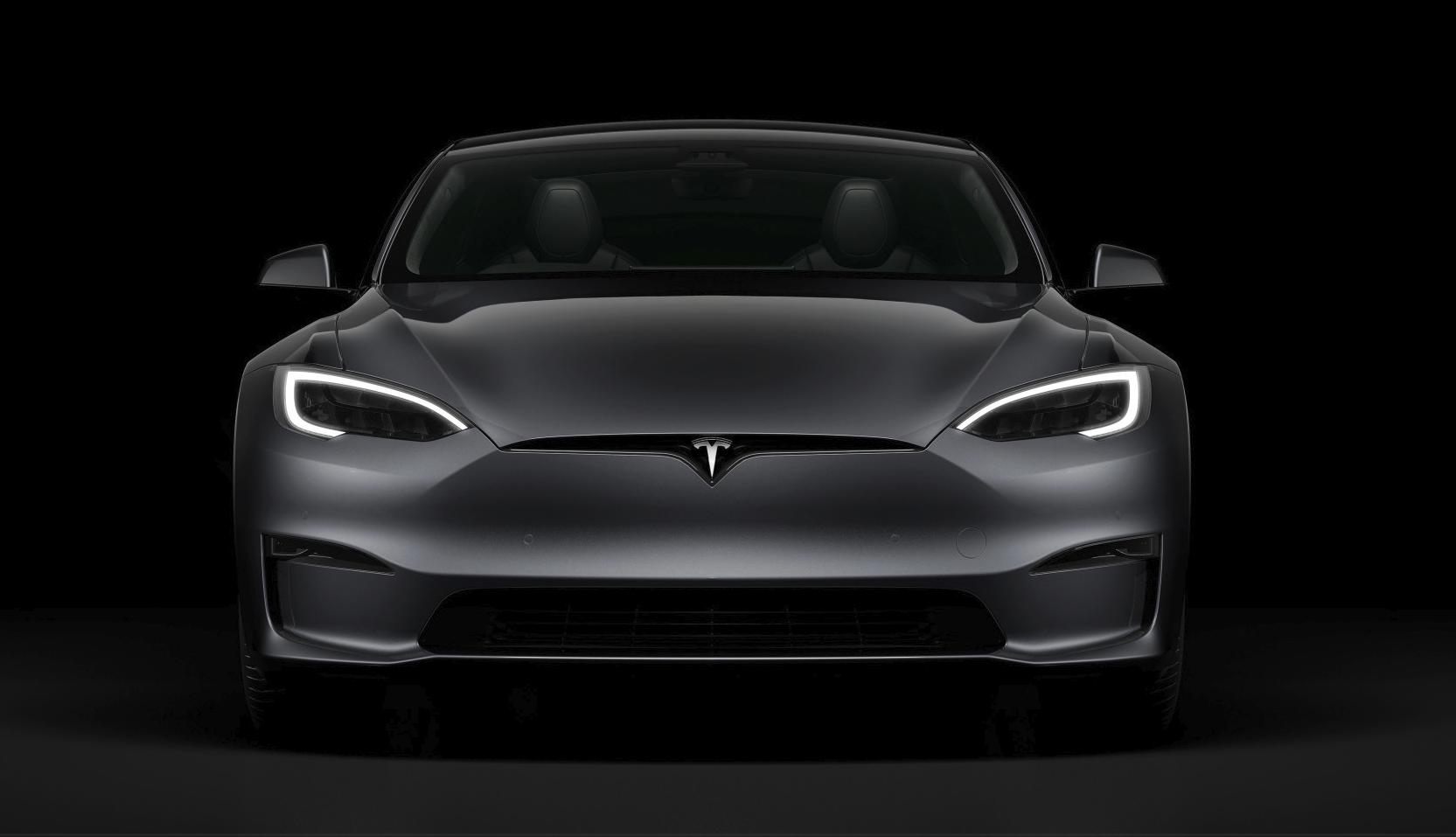

These changes have substantial real-world implications for Colorado residents. For example, the Tesla Model Y Standard Range will effectively be priced at $34,990, making it an appealing option for buyers in the state. However, it is important to note that to qualify for these tax benefits, one must be a taxpayer in Colorado.

Colorado has consistently shown its commitment to supporting EV adoption through favorable tax policies. In addition to the increased tax credit, the state also offers up to $1,000 in tax credits for EV charging equipment. Furthermore, Colorado even extends financial incentives of at least $300 to individuals purchasing e-bikes, further promoting sustainable transportation alternatives.

While the adoption of similar EV tax credits by other states remains uncertain, the significant strides made by Colorado are hard to ignore. The introduction of this legislation also marks the resurgence of the $35,000 Tesla, albeit exclusively available in Colorado. However, there is a caveat; Tesla must not increase the pricing of the Model Y Standard Range before July 1st, giving prospective buyers a limited window of opportunity.

Colorado’s decision to enhance its EV tax credit is a game-changer, enabling more residents to embrace sustainable transportation. By making EVs more affordable, the state is actively encouraging eco-friendly mobility solutions. The impact of this forward-thinking policy goes beyond financial savings, promoting a cleaner and greener future for Colorado and setting a positive example for other states to consider.