In a dynamic move to challenge Tesla’s Full Self-Driving (FSD) Beta V12, several burgeoning Chinese automakers are strategically investing in the development of autonomous driving architecture models grounded in end-to-end neural networks, as reported by local media outlet LatePost.

Nio, a notable player in the electric vehicle (EV) realm, is gearing up to introduce active safety features based on end-to-end technology in the first half of this year. An insider at Nio shared insights, stating, “If it moves forward smoothly, Nio will be the fastest among Chinese companies to mass-produce end-to-end features. To that end, a team of nearly 100 people at Nio has been working on it for nearly half a year.”

Li Auto is making strides, set to launch a new model in the first half of the year, and is actively recruiting top-tier smart driving talent. The move signifies a concerted effort by Li Auto to position itself as a formidable contender in the autonomous driving technology race.

He Xiaopeng, Chairman and CEO of Xpeng, declared on January 30 that the company’s end-to-end model will be seamlessly integrated across its entire fleet, signaling a comprehensive adoption of this cutting-edge technology.

The race to replace traditional technologies with end-to-end architectures is identified as a pivotal trend in China’s smart driving space this year, as elucidated in the LatePost report. The report underscores the convergence of various modules – encompassing perception, prediction, decision-making, and control – traditionally managed by engineers in disparate fields into a unified, end-to-end approach.

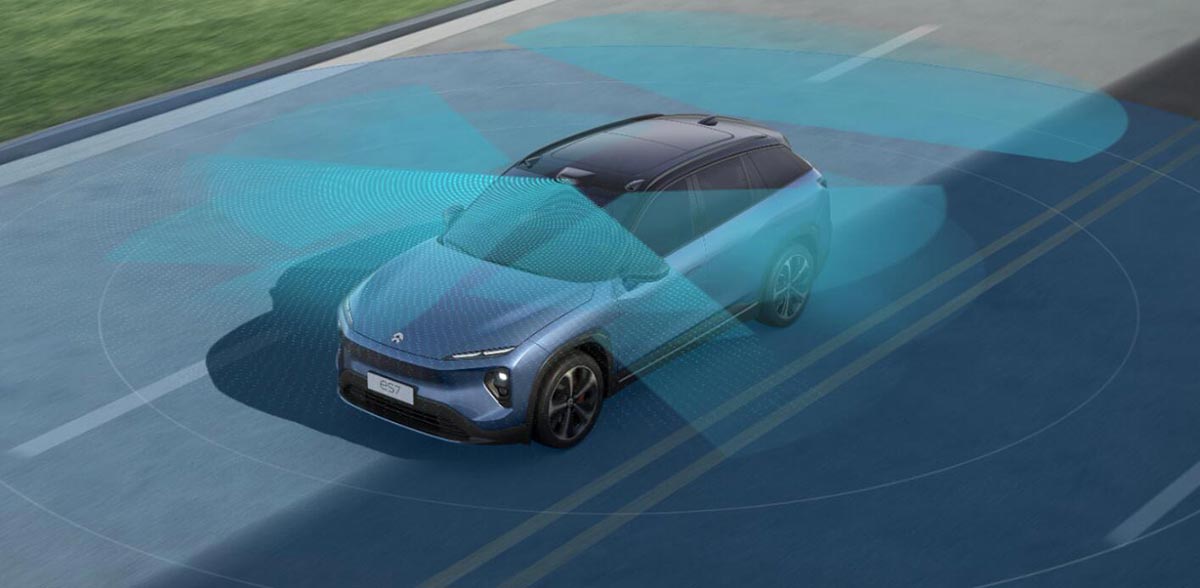

While some companies, like Huawei, continue to rely on extensive teams of engineers writing rule-based code, the report suggests that an end-to-end smart driving system could streamline processes. This system would use sensor data directly in the vehicle’s control commands, with intermediate processes relying on neural network models.

However, challenges persist, particularly in decision-making, posing difficulties for the widespread adoption of the end-to-end system. A source in the smart driving space stated, “The cost of switching from common architecture to end-to-end technology is very high, and the chain is very long. By the end of this year, maybe 10 percent of the functionality could be switched to an end-to-end system.”

Despite the ambitious plans of leading Chinese automakers, the report underscores the current immaturity of end-to-end technology. Industry insiders predict that once the technology matures, competition will intensify, with differences in end-to-end capabilities becoming a significant factor in differentiating brands. Nio’s Head of Smart Driving Products and Experience, Harry Wong, noted on Weibo that “end-to-end” is poised to become the dominant smart driving marketing term this year, following the trend of “HD map-free” in the previous year.