In a rapidly evolving landscape within the automotive industry, the expanding reach of Tesla’s Supercharging network and the emergence of carmakers establishing their own charging infrastructure could potentially spell trouble for established charging networks in the United States.

Recent quarterly filings from industry players ChargePoint and Blink Charging have revealed a concerning financial outlook, with both companies left with less than a year’s worth of cash. ChargePoint’s net cash used in operating activities rose from $71 million to $104 million in the first fiscal quarter, causing its cash reserves to plummet from $541 million to $314 million. While the company aims to reduce losses by two-thirds by the fiscal fourth quarter ending January 31, its financial position remains precarious.

Blink Charging faces a similar narrative. Having spent $65 million in the first half of the year, double the expenditure from H1 2022, the company now possesses a mere $75 million in cash reserves. Brendan Jones, CEO of Blink Charging, attributed these financial challenges to outdated technologies and reliability issues that have left electric vehicle (EV) owners frustrated. Jones emphasized the need for improving the quality of their charging infrastructure.

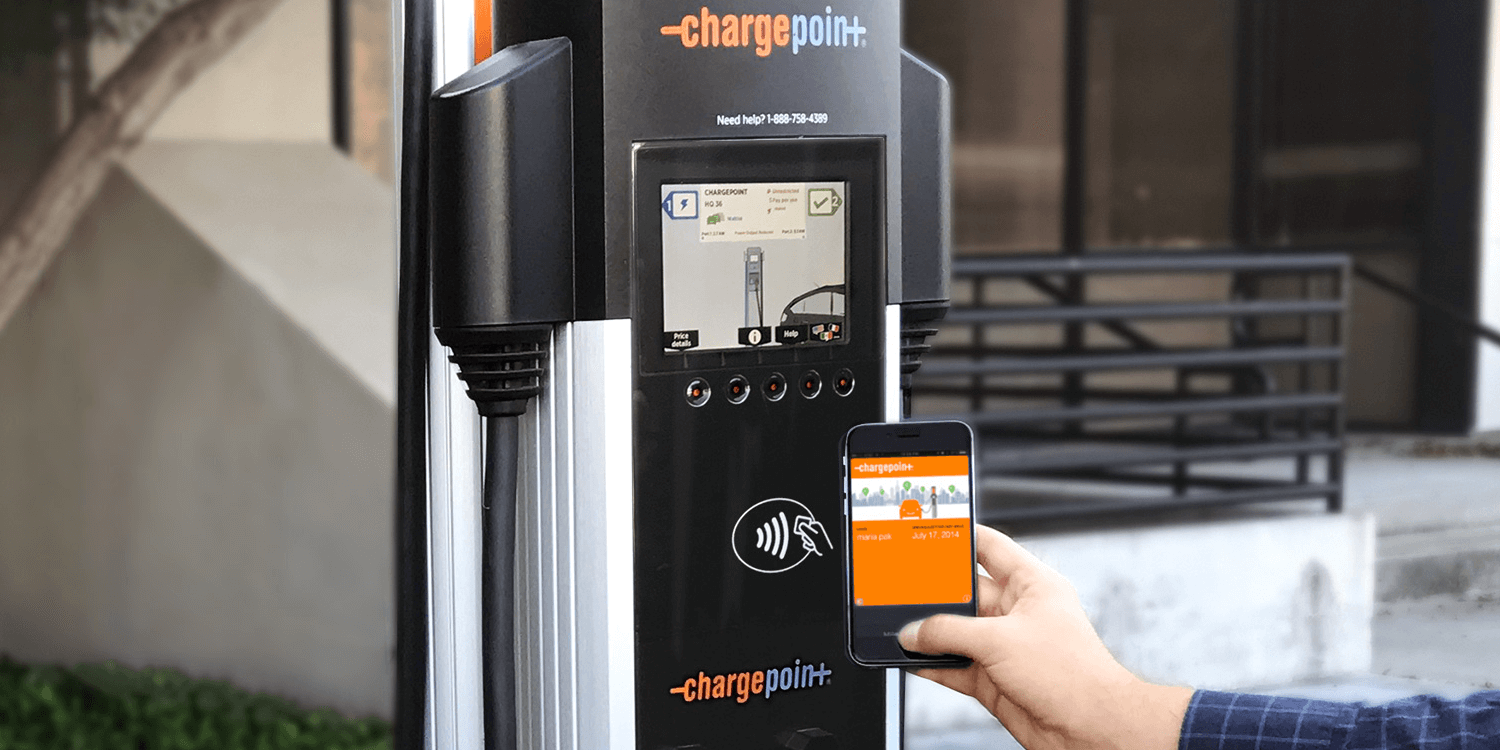

At one point, ChargePoint, Blink, and EVgo were considered formidable rivals to Tesla’s Supercharger network. ChargePoint’s partnerships with renowned automakers like Mercedes-Benz, Toyota, and Lexus, along with Blink’s collaborations with Mitsubishi, Subaru, and General Motors, bolstered their positions. However, a growing number of car manufacturers have expressed concerns about the reliability of these charging networks, leading them to opt for Tesla’s North American Charging Standard connector. This move ensures compatibility with Tesla’s Supercharger network, thus influencing new EV production commitments.

Sam Abuelsamid, an analyst from Guidehouse Insights, aptly described the predicament faced by charging companies, stating, “It’s kind of a perfect storm for charging companies. They’re facing new competition, and their customers are not happy, and they need to spend money, but they can’t get the money, so it’s kind of the worst of all worlds for them.”

A recent survey conducted by J.D. Power unveiled a concerning trend: satisfaction levels with charging networks have hit an all-time low, with nearly 20% of charging attempts proving unsuccessful.

Adding to the challenge, a joint venture formed by prominent automakers such as BMW, GM, Honda, Hyundai, Kia, Mercedes-Benz, and Stellantis announced plans to establish their own EV charging network in North America starting in 2024. This initiative further threatens the presence of ChargePoint and other established charging companies, underscoring the industry-wide shift towards more reliable and accessible EV charging solutions.