CATL, the world’s largest battery producer, is weighing a U.S. expansion if President-elect Donald Trump opens the electric vehicle (EV) supply chain to Chinese investments, Robin Zeng, CATL’s founder and chairman, told Reuters.

“When we initially considered investing in the U.S., the government blocked us,” Zeng said. “But I’m open-minded,” he added, referencing the possibility of a policy shift. U.S.-China trade tensions, intensified by Trump’s first term, led to tariffs and barriers that prevented Chinese EV and battery companies, including CATL and rival BYD (002594.SZ), from entering the U.S. market. Biden-era policies restricted federal EV incentives for Chinese-made batteries, and tariffs made imports costly. Zeng’s remarks mark the first statements from a Chinese supplier to U.S. automakers following Trump’s recent victory.

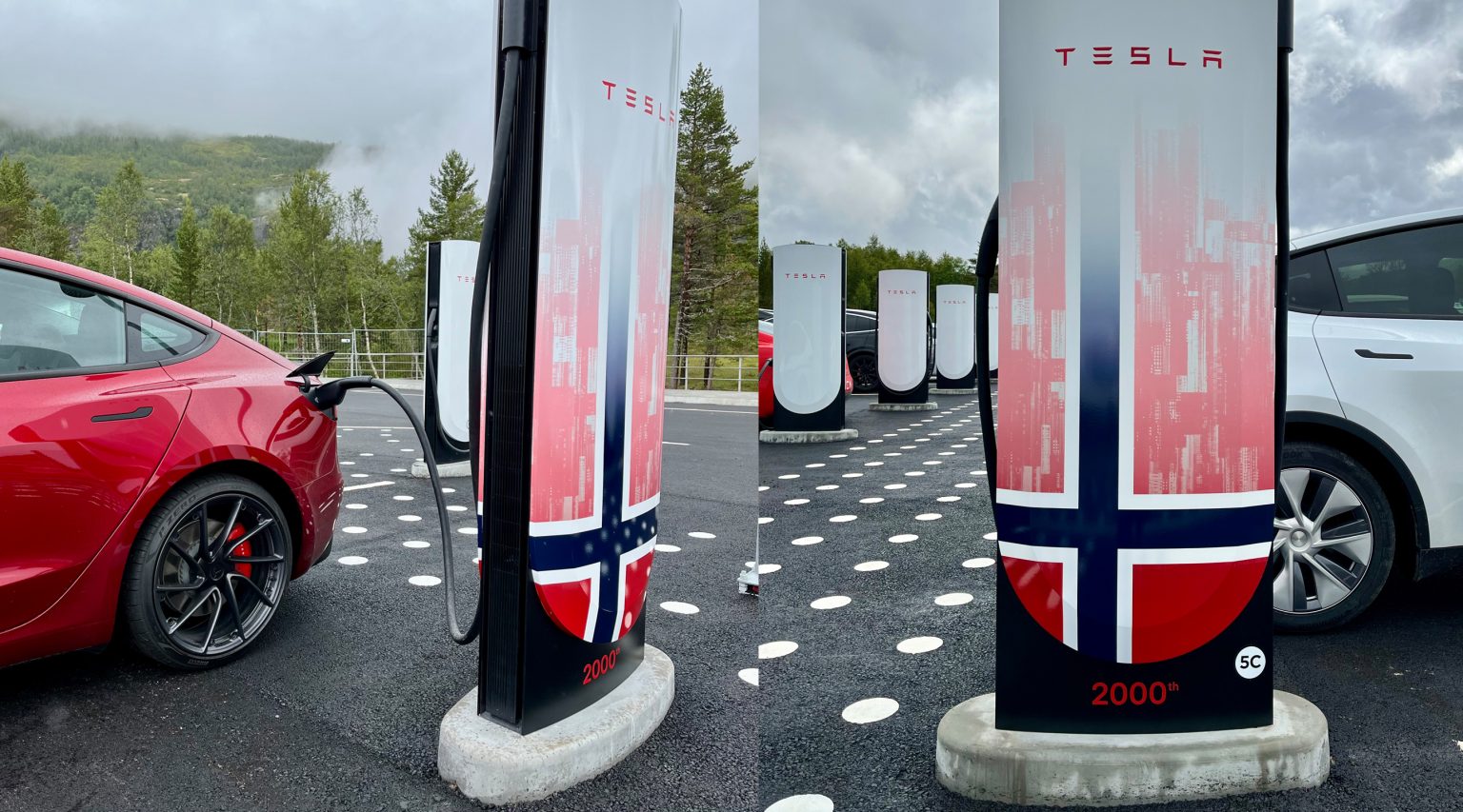

While Chinese battery tech has largely been excluded from U.S. consumer incentives, CATL has remained active through technology licensing. Ford (F.N) plans to use CATL’s low-cost lithium-phosphate battery tech for its EV models at a Michigan plant. Tesla (TSLA.O), which relies on CATL as a major supplier in Shanghai, has a licensing deal for battery production in Nevada set for a 2025 launch.

Zeng, speaking from CATL’s Ningde headquarters, highlighted ongoing discussions with Tesla’s Elon Musk about battery technology. Despite Tesla’s reliance on CATL for supply in Shanghai, Zeng expressed skepticism over Musk’s focus on cylindrical 4680 batteries. “It’s about electrochemistry,” he said, suggesting that the design may be unfeasible. The two frequently discuss Tesla’s ambitions in AI and autonomous vehicles. Zeng noted Musk’s tendency to set aggressive timelines, saying, “He probably knows it needs five years but sets two years to motivate his team.”

CATL’s U.S. plans may gain traction under Trump’s potential incentives, allowing CATL to expand its role as an industry leader and foster U.S. job growth while navigating trade barriers.

Source: Reuters

See Also

- Senator Manchin Urges Stringent Standards to Safeguard U.S. EV Tax Credits from Chinese Influence

- US and Europe could end reliance on Chinese EV batteries by 2030 with more than $160 billion investment

- U.S. Senators Urge Swift Action to Bridge 10 to 20-Year Gap in Battery Tech with China

- EV Battery Prices Drop Significantly, Paving the Way for Cheaper Electric Vehicles

- US Department of Energy Approves $2.26 Billion Loan for Lithium Nevada’s EV Battery Project