German engineering firm Manz AG, known for manufacturing equipment for battery production, has announced plans to file for insolvency proceedings due to insolvency and overindebtedness. The decision follows a breakdown in funding support from lenders and an abrupt end to talks with potential investors.

Manz confirmed its Managing Board will file for insolvency in the coming days, citing an inability to meet financial obligations and overindebtedness under German insolvency law. “Discussions with one of the interested investors were at an advanced stage but were unexpectedly broken off,” the company said in a statement. Efforts to secure alternative financing had failed, leaving no viable solution to sustain operations outside insolvency proceedings.

Financial Struggles Amid Industry Challenges

Manz, which reported revenues of €250 million in 2023, had been grappling with profitability issues, posting losses in its most recent financial statements. The company employs 1,435 workers and specializes in automation, metrology, and laser processing technologies vital for battery production. Despite high-profile partnerships, including deals with BMW and Daimler Truck, the firm struggled to navigate delays and scale reductions in Europe’s battery sector.

The press release did not elaborate on the factors leading to its financial difficulties, but industry observers note the broader challenges in the European battery supply chain. For instance, Britishvolt, a Manz client, filed for insolvency in late 2022, leaving equipment suppliers like Manz exposed.

Manz intends to continue discussions with potential investors during the insolvency process. However, the collapse of advanced negotiations with one key investor raises concerns about the company’s ability to secure new funding.

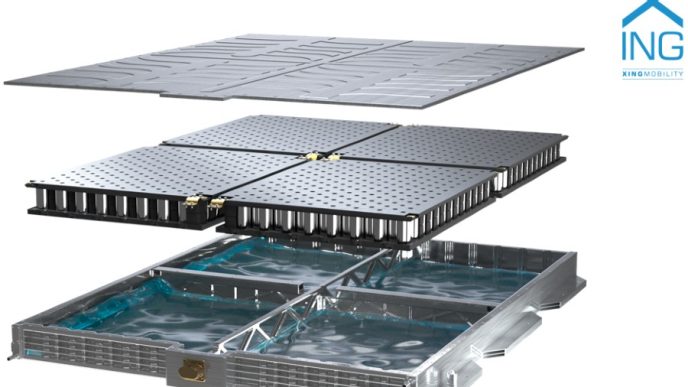

The firm’s reputation as a supplier of cutting-edge battery production systems, including cell contacting systems, remains a critical asset. Still, its insolvency highlights the fragile state of Europe’s battery production ecosystem, where delays and unfulfilled projects often strain upstream suppliers.